mame

Well-Known Member

Ah, I actually looked it up.. this is correct.There are 6 brackets: 10, 15, 25, 28, 33, 35

edit: did some more research... there used to be as many as 15 brackets. eh nevermind.

Ah, I actually looked it up.. this is correct.There are 6 brackets: 10, 15, 25, 28, 33, 35

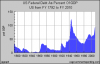

You're right. Math error on my part.Here is 2008:

http://spreadsheets.google.com/pub?hl=en&hl=en&key=0AjrKFiusfAd9dHZuSWExS2RBNF8wei1WZmgyTG1yWkE&output=html

You say the top 400 families, how many people are in those families?

Here is the total IRS tax returns for 2008: http://www.irs.gov/pub/irs-soi/08in11si.xls

Also, I have to call into question your math.

345,000,000

x 400

138,000,000,000

138 billion is a far cry different than 1.4 trillion So even if you just robbed those people blind it wouldn't make any difference.

The problem with privatizing medicare or social security is that you aren't going to save any money considering all you've done is throw the profit motive and an extra set of middlemen into the mix. Paul Ryan's plan doesn't save us any money. Simple things can be outsourced (many cities have outsourced trash disposal and janatorial services) and they'll save money - but things as big and complicated as our entitlement system need to remain in house.Yes, higher taxes and less benefits. That is what I said before. That is the only way you can dig out of this hole. I am all for cutting military spending, and all businesses should pay the same tax rate. However, the higher taxes on the rich even in this situation would still be far too much to keep them under that 70% mark. It would have to be tax increases across the board or a massive cut in benefits overall. As far as privatization, if it makes sense then I am not completely against that. We might pay it off in 50 years at the rate you are talking, maybe. It is a bitter medicine but I think we should just swallow and get to work with it.

- (minus) stuff that accounts for 1% or less of the budget.You've totally lost me now, I have NO idea what you are talking about.

1) I asked you what the pie chart represented

2) You said and I quote "It represents where our tax dollars go-stuff that accounts for 1% or less of the budget"

3) Now you're saying that they are 90% of the budget, which is it?

Do you see how little robbing all those people would help now?You're right. Math error on my part.

There is no serious solution to our debt that does not include increasing revenue.Do you see how little robbing all those people would help now?

Agreed. You must also cut the government by about 20%. That is just the fact of it.There is no serious solution to our debt that does not include increasing revenue.

there were as many as 26Ah, I actually looked it up.. this is correct.

edit: did some more research... there used to be as many as 15 brackets. eh nevermind.

Well also major corporations pay almost no tax. Corporate tax used to account for over 30% of our revenue now it accounts for only ~7%.Once again, even if you took all the money that everyone in the country made over 200k it wouldn't cover our budget and those people wouldn't bother working anymore. We don't even have enough money in America to pay for the budget our politicians are giving us without deficit spending or big tax hikes for the low and middle class. Also, please, when you consider taxes, include all taxes like you would if we were talking about the lower/middle classes. Also, please remember that the more money you hold the harder the government inflating the money hurts your holdings. I reiterate that the problem we face as a country isn't how much we are taxing the rich, it is how much we are spending.

We aren't "robbing" anyone. We are asking them to pay their fair share. Warren Buffet pays a lower % wages in taxes than his secretary. It's not robbery to correct that error.Do you see how little robbing all those people would help now?

Really, you're going to run out FDR's New Deal as proof as liberalism works, when FDR's New Deal prolonged the Great Depression by 7 yearsFunny you ask: https://www.rollitup.org/politics/422497-wheres-proof-librulism-works-5.html

There is plenty of sourced information in the linked thread - among others - to support its effectiveness.

Everyone is being robbed. When the Supreme Court has ruled against paying tax on wages and those taxes are enforced by confiscation of all property and incarceration, we are ALL being robbed.We aren't "robbing" anyone. We are asking them to pay their fair share. Warren Buffet pays a lower % wages in taxes than his secretary. It's not robbery to correct that error.

When the wealthy did pay their fair share in taxes, we didn't have huge deficit problems. Those problems only came around when we started cutting their taxes.

Really, you're going to run out FDR's New Deal as proof as liberalism works, when FDR's New Deal prolonged the Great Depression by 7 years

Proof that adherence to the Constitution works=the first 122 yrs of our country.

You don't fix that by raising the tax %. You fix it by making the tax simpler with little to no write offs across the board. The entire IRS is a big game. Keep progressive taxation, fine. Make the first 20k tax exempt, whatever. Why do we have families making 60k that pay no taxes, but a couple without kids takes it in the rump? People should be responsible for themselves, not their neighbors. Why should a couple without kids hold the burden for the couple with kids? Should I get a tax write off for having dogs? You choose to have kids, you choose to buy a house, having dogs is little different.We aren't "robbing" anyone. We are asking them to pay their fair share. Warren Buffet pays a lower % wages in taxes than his secretary. It's not robbery to correct that error.

When the wealthy did pay their fair share in taxes, we didn't have huge deficit problems. Those problems only came around when we started cutting their taxes.

We could cut hundreds of billions and not even touch the economy right now. When you are broke and have to borrow money to keep living you don't keep your cable bill and 5 dollar a day star bucks coffee, you cut those items out. We could just walk away from the wars we are in and that would be a tremendous savings right there.Well also major corporations pay almost no tax. Corporate tax used to account for over 30% of our revenue now it accounts for only ~7%.

You also have to remember that we are in a recession. This isn't a normal debt rate. Debt rates always increase during a recession. I don't believe there has ever been an exception to that in this country since the industrial revolution.

We aren't averaging that much debt per year, we don't need to raise average tax revenues by 1.4 trillion per year.

You have to accept the fact that there is going to be a deficit during a recession, because it is a fact. Even conservative hero Reagan ran unusually huge deficits during a recession. Why do you think this should be different than every recession in the history of our country? Why is it so important that the budget gets balanced right now. Any serious attempt to balance the budget right now will likely result in a double dip recession. Is it really worth potentially millions of people losing their jobs?

The deficit is a long term problem that should be addressed. But we have an immediate problem right now that is more important. We will not have the same revenue problems once the economy is recovered and people are back to work.

Imagine if space monkeys had landed in Iceland 100 years ago, we would all be speaking Icelandic! Yea.. my grandmother used to tell me "If wishes were horses, beggars would ride" Keep wishing for revised reality lol.Wow. You cited the only evidence that Conservatives on this site have ever put forward ever in the history of ever.

Unfortunately for you, that paper(for it's main assertion, that the New Deal prolonged the Depression) has been discredited for a while now. You see, the UCLA paper has a good point(in that NIRA was bad) but basically, what the UCLA study concluded was that inflated prices and wages were the cause of the slowed recovery, and the NIRA which FDR signed into law was the cause of that inflation, resulting in a 60% weaker recovery. However, NIRA was deemed unconstitutional by the Supreme Court only two years later(and so was not in effect for the duration of the New Deal) and so the consensus has since been that while the NIRA policy was quite the blunder(having slowed the recovery, as shown... AND it was unconstitutional) - the rest of FDR's New Deal is considered a success. This is evidenced by it still being the fastest recovery in the history of the nation(Market forces alone have never produced that fast of a recovery, Imagine if NIRA was never signed into law... FDR's policies would have been deemed even more effective).

It's funny because that 2004 UCLA study is widely regarded by many to be a conservative attempt at revisionism. The New Deal as a whole had a positive effect on the economy. The study says that market forces would have been able to work at a pace 60% faster than they would have without NIRA in effect for those two years. That's all well and good, but how fast exactly do market forces move? The answer is, historically, at a glacial pace. That is why the New Deal is still credited with speeding the recovery of the great depression. There is no evidence to suggest that market forces alone could drop unemployment from over almost 24% to 14.6% that's 4 million people who gained employment in that time, the New Deal did, in fact, preside over the fastest recovery in history and to credit market forces alone is at best misguided and at worst sabotaging the future.Keep wishing for revised reality lol.